by Valerie Leach

Economic growth

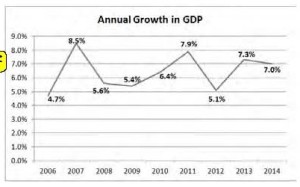

The Tanzanian economy continues to grow, at a rate of 7% in 2014. (Hali ya Uchumi 2014). Construction, transport and financial services were the fastest growing sectors.

Estimated GDP per capita was TSh 1.72 million (USD 1,038), a small real increase over the year. This allowed the Minister of Finance, Saada Mkuyu, to state in parliament that Tanzania is on the verge of achieving middle-income status.

Employment

Over 1 million people were added to the payroll in the private sector in the ten years 2005 to 2014, increasing the number of people formally employed from just over 1 million in 2005 to over 2 million in 2014. The National Bureau of Statistics reported results from the Employment and Earnings Survey of 2014. The biggest growth in formal sector employment was from 2012 onwards and in the private sector. Dar es Salaam, Morogoro and Arusha feature in the NBS’ report as regions with especially strong growth. One-third of all formal sector employees are reported to be in Dar es Salaam.

There was a big jump in the number of newly recruited workers in 2014 and in their average earnings, with changes in new recruitment particularly strong for professional and technical employees. The percentage of formal sector employees who are female – 37% – has not changed in this ten-year period.

Unemployment rates have, accordingly, fallen, mostly among urban male adults. Changes were negligible for younger people, among women and people in rural areas.

Prices

Prices increased by 6.1% in June – the same rate as a year earlier, but higher than the 4.5% and 5.3% in the two previous months. As is usual, increases in the prices of foodstuffs were the main cause of the increase in prices overall.

Exchange rates

The fall in the value of the Tanzanian shilling, depreciating by almost 20% in the first five months of the year, was reported with great concern in the newspapers. Much of the change was attributed by the Ministry of Finance to the strength of the dollar.

Recent inflows of external funds resulting from increased export earnings from tourism, coffee and cashews as well funding from international development banks have stemmed the shilling’s decline.

Currencies in Kenya and Uganda have been similarly affected and central banks in all three countries are reported to be taking actions to tighten liquidity and dealing in foreign exchange. At the time of writing, the exchange rate has recovered to around TSh 2,100 to the dollar, an improvement from the TSh 2,300 reached in June.

The Development Plan

The Annual Development Plan is tabled at the time of the budget. This year, the Parliamentary Standing Committee on the Budget identified the following priorities: managing inflation and depreciation of the shilling; scaling up efforts to reduce income poverty; construction of a new central railway line of standard gauge; increase electricity supply particularly in rural areas; improve rural water supply services; improve irrigation; improve livestock and fishing sectors; accord priority to education and health services; and improve the business environment for private sector investment.

The Annual Development Plan 2015/16 specified the following main policy targets: maintaining peace, stability, unity and strengthening good governance; poverty reduction; sustaining macroeconomic stability; value addition; increasing capacity for storage of food grains and strengthening crop market; attracting more tourists and promoting domestic tourism; and improving private sector participation in implementation of development projects.

Key issues of focus in the plan were identified: completion of ongoing development projects particularly projects in the “Big Results Now” initiative; ensuring food security; improving the business environment; developing human resource skills especially in oil and gas, science, technology and innovation; and mitigating effects of climate change.

The Budget

The budget, announced in June, includes plans to increase revenue from domestic sources and reduce the share of the budget coming from external financing from 14.8% in 2014/15 to 8.4% in 2015/16. Uncertainties about external development funding have led to a reduction in the share of the budget for development expenditure. No new development projects are to be included in the budget, though there is a possibility that the new government after the October elections may choose, through a supplementary budget, to modify priorities and allocations.

Tax revenues currently amount to 12.5% of GDP, not enough to fund much needed investments in infrastructure and social services. The World Bank argues that greater increases in domestic tax revenues are needed through a reformed, more productive and well-managed tax system. Among the measures included in the budget is a new levy on imported goods of 1.5% which is to be earmarked for improvements in the rail infrastructure. It is a measure which has been agreed by all the countries of the East African Community. There is also an increase in petroleum levy on petrol, diesel from 50 to 100 shillings per litre and on kerosene from 50 to 150 shillings, the proceeds from which will go towards rural electrification.

The minimum wage has been increased and the low band PAYE rate lowered from 12% to 11%.

At the time of the budget, the World Bank approved a fund of USD 100 million to help increase transparency and accountability in Tanzania’s governance, and to help improve public financial management.

IMF’s review

The IMF’s assessment of the state of the economy in July was largely positive: “The draft 2015/16 budget, which targets an underlying deficit of 3.5 percent of GDP (excluding arrears clearance), is built on more prudent revenue and foreign financing assumptions. The fiscal target also puts Tanzania on a path to a 3-percent deficit over the medium term, which is consistent with maintaining a low risk of debt distress.”

The Fund, however, also expressed concern about the accumulation of arrears in government payments and actions were urged to have them cleared. It commended a policy paper, approved by the cabinet, for a fiscal framework for managing resources from natural gas which is based on international experience. There will be a Natural Gas Revenue Fund that will be fully integrated into the budget, with no parallel spending authority.

Recent Developments

President Kikwete, at the Dar es Salaam International Trade Fair directed all regional and district commissioners to stop banning the transportation and exportation of produce. He said that such bans do not benefit farmers and business but rather engender corruption.

On a visit to the port of Dar es Salaam, World Bank Vice President for Africa, Dr Makhtar Diop commended its improved infrastructure and efficiency. He pointed out the benefits to the economy of Tanzania and its landlocked neighbours of a well-functioning port.

An aspect of the planned large trading centre at Kurasini has been criticised by a representative of small traders now operating in Kariokoo who believe the new trading centre will benefit Chinese rather than local traders.

Further progress has been made in the reduction of non-tariff barriers to trade in the larger region with an agreement between the governments of Tanzania and Zambia. Border management will be improved with a one-stop border post by the Nakonde-Tunduma corridor which will speed up transit times and lower costs of trading.

Structural change in the economy

Manufacturing is a growing albeit still a small part of the Tanzanian economy. A research paper for World Institute for Development Economics Research (WIDER) by Samuel Wangwe, Donald Mmari, Jehovanes Aikaeli, Neema Rutatina, Thadeus Mboghoina and Abel Kinyondo examined the manufacturing sector in Tanzania. It remains largely undiversified, and vulnerable to variations in agricultural production and commodity prices.

The growth in output and exports, production innovation and product diversity have been most dynamic in the manufacturing of food products, plastic and rubber, chemicals, basic metal work, and non-metallic mineral products. However, the extent to which Tanzanian manufacturers have added value has been limited by their dependence on imported intermediate goods. This limits inter-industry linkages that are important for promoting a domestic manufacturing base and employment.

The authors conclude that various technological, financial, policy and administrative constraints remain unresolved and they are limiting faster industrial growth and transformation.