by Ben Taylor

Maize surplus

Tanzania’s farmers produced a surplus of 2.1 million tonnes of maize during the 2022/23 season, according to Agriculture Minister Hussein Bashe. He explained that the country’s farmers produced 8.1 million tonnes against a demand of 6 million tonnes, adding that production is expected to reach 10 million tonnes in the current (2023/24) season.

“Needy countries have started communicating with us,” said the minister. He advised traders who stored corn last season to continue storing since the Ministry of Agriculture would start issuing export permits for free, and he urged farmers not to sell their products due to overproduction to avoid selling at lower prices; instead, they should reserve to make more profit in the near future. “Prices may change in June, so try to save them, don’t rush to sell,” he advised.

Increase in crop exports

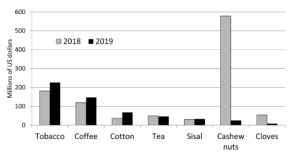

The value of crop exports increased to $2.3 billion in the year to December 2023 from $2.1 billion recorded in 2020/21, according to the Agriculture Minister, Hussein Bashe.

The 10% increase has mainly been attributed to exports of coffee, tobacco, cashew nuts, rice, sesame, legumes and horticultural produce, especially avocados. The minister said in a 2023 performance review that avocado exports increased from 17,711 tonnes worth $51 million in 2020/21 to 26,826 tonnes valued at $77.3 million in 2023.

“Avocados were exported to the Netherlands, France, UK, Spain, Belgium, Russia, Germany, Norway, South Africa, India and the United Arab Emirates. In 2024, Tanzania will start exporting avocados to China,” he says. Avocado production rose from 149,340 tonnes to 195,000 tonnes, making Tanzania the third biggest producer in Africa after South Africa and Kenya.

Cotton exports more than doubled, rising from 32,609 tonnes worth $15.6 million in 2020/21 to 65,771 tonnes valued at $33.5 million in 2023.

Mr Bashe says coffee exports rose more than three-fold from 25,084 tonnes worth $44.1 million to 94,549 tonnes valued at $170.2 million during the period under review.

Some 32,587 tonnes of tobacco valued at $142.4 million were exported in 2023, up from 8,377 tonnes worth $35.2 million that were sold outside in 2020/21.

Tanzania targets bamboo market

Tanzania is turning to bamboo as a key strategy to decrease carbon emissions while simultaneously claiming a share of the lucrative $7 billion global market. Bamboo is also in high demand in China and other countries where it is used for furniture.

At the launch of the National Bamboo Development Strategy and Action Plan for 2023-2031 on February 19, the minister for Natural Resources and Tourism, Ms Angellah Kairuki, said bamboo can reduce carbon emissions by 40 percent.

The target set in the strategy is to plant a total of 10,000 hectares of bamboo plantations and woodlots by June 2031, as well as establish two bamboo seed orchards. “Countries like China are currently selling carbon through the bamboo crop,” explained biodiversity lecturer at the Sokoine University of Agriculture (Sua), Dr Paulo Lyimo. “Tanzania can also enter the market because it does not take long to grow: just five years, unlike other sources of timber, which take up to 100 years,” he said.

US rice donation to Tanzania under scrutiny

A donation of fortified rice, given by the US Department of Agriculture and Global Communities, a US-based NGO, prompted a heated debate on social media. The debate started on the X platform (formerly Twitter) after the US Embassy in Tanzania posted a picture showing bags of the rice, saying that it was a donation to “provide nutritious meals to students at the over 300 participating schools in Dodoma.”

Just hours later, Minister of Agriculture Hussein Bashe spoke out, saying that importers should not have brought in that rice since Tanzania has its own rice reserves. He added that if the issue was with the fortification or nutritional content of the rice, they should work to improve rice production and processing in Tanzania rather than undermining local markets.

“We told the NGO, tell the Americans that we have rice and beans in this country, and the money they use to give American farmers, they should give it to Tanzanian farmers. Let’s buy rice and beans from Tanzania, and then let the nutrients they want to add be added here in Tanzania; we all see that,” said Bashe, emphasizing that he has informed the NGO that Tanzania is self-sufficient in food.

Tanzania expects to harvest 5 million tonnes of rice this year, up from an estimated 2.3 million tonnes previously, while national demand for the staple food stands at slightly over 1 million tonnes.

The donation was part of the Pamoja Tuwalishe (Together let’s feed them) initiative, a project of the US Department of Agriculture, in collaboration with Global Communities. “This program reflects the U.S. commitment to fostering health, education, and opportunity for children across the globe,” the Embassy wrote.

Global Communities said it began implementing the first phase of the McGovern-Dole Food for Education project in Tanzania in 2010 with funding from the USDA. The programme is now in its fourth phase.