by Ben Taylor

National budget endorsed

Members of Parliament (MPs) overwhelmingly endorsed the 2017/18 national budget: of 355 votes cast, 260 voted to approve the budget and 95 voted against. All but two opposition legislators voted to oppose the budget.

Finance and Planning Minister Philip Mpango announced the abolition of Value Added Tax (VAT) on hunting fees, licences and permits in order promote business in the sector. He also relieved private schools of skills development levy and fire extinguishing fees, expressing the hope that school owners will reduce their fees and enable more Tanzanian children to access private education. Further, industrial investors will no longer have to pay for the Environmental Impact Assessment (EIA) fee, said the Minister.

“The property tax is charged on permanent structures in cities, municipalities, towns and townships…villages and mud houses will not be taxed,” he clarified, adding that houses for people aged over 60 years are also exempted.

During the debate, a proposed property tax of TSh 10,000 and TSh 50,000 per ordinary house and storied buildings, respectively, were decried, with legislators describing the taxing of rural mud-built and grass-thatched houses as unfair and unjustifiable. The Minister clarified that “the property tax is charged on permanent structures in cities, municipalities, towns and townships … mud houses and houses in villages will not be taxed.” He added that houses for people aged over 60 years are also exempted.

Dr Mpango also defended the replacement of the annual motor vehicle licence fee with a levy of TSh 40 per litre on fuel, saying the move will relieve motorists with the burden of fee, which is costly. He dismissed claims by many MPs that taxing fuel was burdening the poor for the benefit of motorists, mostly urban dwellers, saying the collected taxes will be used to finance development projects and social service provision for the benefit of all, rural dwellers inclusive.

Deputy Minister for Finance, Dr Ashatu Kijaji said the government was committed to fulfilling President John Magufuli’s campaign promise to disburse TSh 50m to each village, saying already the State has already allocated about TSh 120bn for the purpose.

“We remain committed to release this money but there are issues that must be tackled…we are currently working on firm systems to support the distribution of the money,” said Dr Kijaji.

The Minister of State in the President’s Office, Public Service Management and Good Governance, Angela Kairuki said she would permanently verify the authenticity of public servants to ensure that not a penny from government coffers will be paid without proper justification.

“Let me be referred to as minister of verification, if necessary,” said the Minister, declaring the introduction of performance contract system for all executives in the public sector.

The opposition camp in parliament took issue with the budget, saying it contained serious, unexplained discrepancies and that it was crafted on the basis of an ambitious but unrealistic revenue assumptions. The Shadow Finance and Planning Minister, Ms Halima Mdee, is unable to attend sessions in parliament until February 2018 following a ban issued by the speaker. Her response to the budget was therefore issued to journalists.

Miss Mdee said the presented budget seems to be bent on killing the Decentralisation by Devolution (D by D) plan which seeks devolve powers from the central to the local government authorities. D by D started out of the admission that the central government had failed to do everything. Unfortunately, the central government is now grabbing the powers of collecting property tax and city service levy away from local government authorities,” said Ms Mdee.

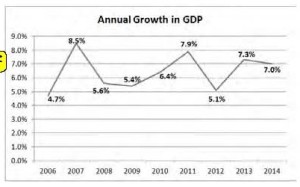

Earlier, when tabling the budget, Mr Mpango acknowledged the concern of the increasing frequency of businesses closure in Kariakoo, Dar es Salaam and in other cities. He said figures from the tax authority, TRA, showed that from July 2016 to March 2017, a total of 7,277 businesses were shut down. “This trend is discouraging since residents lose jobs and incomes and the government loses tax revenue, while the economy slows down,” he said.

He told parliament that factors contributing to business shutdown include stiff business competition, weak business management, increasing business operating costs attributed to transportation, taxes and levies; and non-compliance to business rules and principles. He also reminded the house that it is worth noting that business owners have become aware of the need to report to TRA as soon as they cease their business operations in order to avoid accumulation of tax liabilities, and that a much larger of new businesses were registered during the same period.

He compared this situation to that of China since the 1980’s, quoting from a book on the subject: “Businesses at the time were like ships, each raised up and carried along by the sheer momentum of the wave. Some, however, soon capsized and were swallowed up, while most drifted along, going with the flow. Others crashed against barriers in the sea or got stranded on deserted islands. Only a few rose atop the crest of the wave and survived, eventually sailed towards new lands.”

The Minister refuted accusations that the government was anti-business, reassuring business leaders that the fifth phase government recognised business as the engine of the economy and recognised the contribution of business to national development. He pointed to the government’s efforts to maintain economic stability, peace and security, reduce regulation and to development national infrastructure as evidence of the government’s pro-business credentials. He also reminded TRA officials to act fairly and in accordance with the law when dealing with tax payers. (The Citizen, Daily News)

Case against Manji heard at Muhimbili National Hospital

Kisutu Magistrate’s Court in Dar es Salaam briefly relocated to Muhimbili National Hospital (MNH) in July, where prominent businessman Yusuph Manji and three others were charged with seven counts relating to military uniform fabrics worth over TSh 200m. Other charges relate to illegal possession of government stamps, which are three rubber stamps of the TPDF bearing different addresses and two motor vehicle plate numbers of government offices suspected to have been unlawfully acquired. Manji is charged alongside three officials with Quality Group, the firm he heads.

Manji has for several months been a patient of the Jakaya Kikwete Cardiac Institute under police supervision after initially being arrested on immigration-related charges.

It is alleged that on June 30, the accused persons were found by a police officer in possession the fabric, stamps and number-plates without lawful authority. The prosecution alleges that this was prejudicial to the safety or interests of the United Republic of Tanzania.

Manji and his co-accused were not required to enter a plea at this stage.

(Daily News, The Citizen)