by Ben Taylor

Tanzania pull-outs of EU-EAC Economic Partnership Agreement, Brexit cited

Tanzania has decided not to sign the proposed Economic Partnership Agreement (EPA), which would have opened up trade between the European Union (EU) and the East African Community (EAC). Dr Aziz Mlima, permanent secretary in the Ministry of Foreign Affairs, made the announcement in early July.

“Our experts have analysed the pact and established that it will not be to our local industry’s benefit. Signing this pact at the moment would expose young EAC countries to harsh economic conditions in post-Brexit Europe,” explained Dr Mlima.

Minister for Trade, Industries and Investment Charles Mwijage said Britain was Tanzania’s key trade partner in Europe. “Internationally, we trade with Britain, China, India and South Africa. When you don’t have Britain in a deal with Europe, what do you have? We have to think it over and this can take any duration to decide,” he said.

The move appears to fit with President Magufuli’s economic policies, which include a greater focus on raising tax revenues and on protecting local industry. A few weeks before the decision on the EPA was announced, the President gave a speech in which he called for imported good to be subject to higher taxes in order to protect local producers.

“We have every reason to protect our industries,” he said. “They generate direct employment for our people and provide our farmers with reliable markets for their produce. The government collects revenue from them and they play a key role in spurring economic development. That is the direction I want to take, and I know the Minister for Industry, Trade and Investment (Mr Charles Mwijage) is here…this is what I want him to do.”

Former Tanzanian President, Benjamin Mkapa, expanded on the decision in an essay published various Tanzanian and regional newspapers.

“If we sign the EPA, we would still get the same duty-free access, but in return, we would have to open up our markets also for EU exports,” he explained. “Tanzania would reduce to zero tariffs on 90% of all its industrial goods trade with the EU i.e. duty-free access on almost all EU’s non-agricultural products into the country. Such a high level of liberalisation vis-a-vis a very competitive partner is likely to put our existing local industries in jeopardy and discourage the development of new industries.”

“As a Least Developed Country (LDC), Tanzania already enjoys the Everything but Arms (EBA) preference scheme provided by the European Union i.e. we can already export duty-free and quota-free to the EU market without providing the EU with similar market access terms.”

Kenya, Rwanda and Burundi were ready to sign the Economic Partnership Agreement (EPA) with the EU, but Uganda indicated that no agreement should be signed without full agreement of all EAC member states. World Trade Organisation rules do not allow countries aligned to a trade bloc to sign up individually.

In the short term at least, Kenya is seen as the biggest loser from Tanzania’s decision, as the country’s middle-income status means Kenya does not currently have the same tariff-free access to European markets that the other EAC members enjoy. Nevertheless, at current growth rates, Tanzania will itself achieve middle-income status within the next couple of years.

Austerity budget

Dr Philip Mpango, the aptly-named Minister of Finance and Planning presented an austerity budget to parliament in June. The budget scrapped a wide range of tax exemptions while increasing taxes on sugar, cement imports and beverages, and doubled down on President John Magufuli’s cost-cutting measures with tight restrictions on ministries’ and departments’ operating costs.

Tabling the TSh 29.54tn (US$14bn) budget for the 2016/17 financial year in Parliament, Dr Mpango introduced income tax on the gratuity that MPs earn after every five years and offered relief to small-scale farmers and other low-income earners by scrapping various “nuisance taxes”.

The budget also aims to support the president’s industrialisation strategy, by increasing import taxes on various manufactured goods, including cement, sugar, corrugated iron sheets, and second-hand clothes and shoes.

Dr Mpango, a former World Bank economist, told the house that in the 2016/17 Budget, TSh 17.8tn (60% of the total) would come from domestic sources, TSh 5.37tn (18% of the total) from domestic loans and the sale of Treasury papers, TSh 3.6tn (12%) from foreign aid and development grants, and TSh 665bn (2%) from local government authorities’ sources. Finally, the government plans to borrow TSh 2.1tn (7%) from foreign commercial sources for infrastructure projects.

Some business leaders and economists reacted to the budget with a note of caution, recognising the value of the budget as a bold attempt speed up industrialisation, but arguing that “too much focus” on the private sector in revenue collection could hit investment.

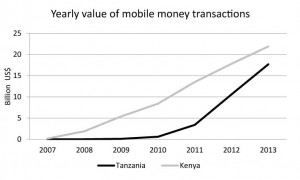

The decision to target key and fast growing sectors of the economy, particularly telecommunications, banking and tourism, will adversely affect the economy, they argued. Further, they also warned that strong enforcement of cost-cutting measures in the budget could hurt businesses and narrow the tax base.

“The newly introduced taxes will hit the banking and tourism sectors hard. These are key sectors of the economy that have yet to reach their full potential. Imposing 18% VAT on tourism services will only succeed in benefiting our closest competitor, Kenya,” said Ernst & Young Executive Director for Tax, Laurian Justinian [see also Tourism & Conservation section].

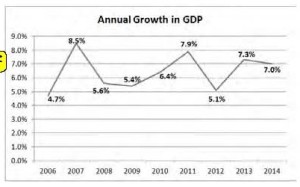

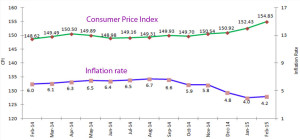

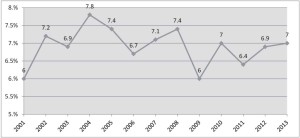

Elsewhere in the budget, Dr Mpango said that Tanzania’s economy will grow by 7.2% in 2016, and the inflation rate, at 5.1% in April this year, will remain between 5% and 8%. Domestic revenue will reach 16.9% of GDP in the 2016/2017 financial year, up from 14.8% in 2015/2016.

However, President Magufuli took issue with official inflation figures, arguing that they appear to be at odds with the economic reality on the ground as many Tanzanians complain about the rising cost of living. “[We’re told] Tanzania’s inflation rate has fallen from around 30% in the 1990s to 5%. But is this really reflected in the lives of Tanzanians?” he queried. “We can just celebrate these statistical data, but in reality people might feel that the inflation rate has actually increased to 70%,” the president added.

Volumes down at Dar port, but revenues rise

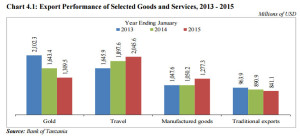

The Commissioner General of the Tanzania Revenue Authority (TRA), Alphayo Kidata, said revenue from the Port of Dar es Salaam has increased in the last two months despite the burdens of a reduction in trade volumes. He said this after the Tanzania Ports Authority (TPA) reported a decline by more than 50% in the freight transported to neighbouring DR Congo and Zambia.

Kidata cited global economic problems, in particular in China, as the main reason for the reduction in volume, adding that a similar effect could also be seen in Mombasa, Beira and Durban.

However, he stressed that despite the decrease in cargo, revenue at the port has increased because they have closed loopholes for importers, ensuring that all appropriate duties are now paid.

The Commissioner said TRA were previously collecting TSh 200-300bn per month from the port but after controlling loopholes, TRA collected TSh 458bn in April of this year, and TSh 517bn (US$250m) in June.

Dr Philip Mpango, the aptly-named Minister of Finance and Planning, told parliament in April that from October 2015 to March of this year cargo had declined at the port, with the number containers from Congo dropping from 5,529 to 4,092. He added that freight to Malawi fell from 337 to 265 containers, while the number heading to Zambia declined from 6,859 to 4,448.

Later, analysts noted that the Dar es Salaam port risks handling the lowest number of vessels in its history this year. Several logistics firms opted to bypass the city after Value Added Tax (VAT) was imposed on transit goods.

Cargo firms took issue with the imposition of VAT, which came even after the Prime Minister, Kassim Majaliwa, agreed that it was standard practice worldwide not to charge VAT on transit goods. A meeting between TRA and the Tanzania Freight Forwarders Association (TAFFA) was postponed when TAFFA representatives were not satisfied with TRA sending a junior representative to the meeting.

Tanzania Economic Update (TEU) published

The World Bank published the latest in their bi-annual series of economic updates, with a mix of praise and criticism for Tanzania’s economy.

The report commended the new government’s measures to strengthen fiscal management and curb corruption, saying they have started to yield results with tax revenue collection exceeding targets.

Nevertheless, the report called for a greater focus on strengthening the private sector, calling for adoption of Public-Private Partnerships as a new source of finance for development projects. “Tanzania needs to improve overall business environment, including through improved access to finance and electricity, for private sector development,” said Emmanuel Mungunasi, WB Senior Economist and co-author of the report. “Further development of the private sector will be key to accessing the needed resources including financing and creating more employment opportunities which are critical for poverty reduction.”

The Bank’s Country Representative, Bella Bird, also noted that Tanzania had been very generous in recent years with tax exemptions, and praised President Magufuli’s commitment to limiting such exemptions.

Critics took issue with some aspects of the report, notably a warning that over-dependence on China as an economic partner could leave Tanzania vulnerable to faltering growth in the East Asian giant.

“The saviour of industrial policy is China and other developed nations of the East. We stand to gain from China’s relocation plans. It is the right time to grab the opportunities,” said Prof Humphrey Moshi of the University of Dar es Salaam.

Standard Bank compensation payment

The outgoing British High Commissioner to Tanzania, Ms Diana Melrose, announced on Twitter that the UK has transferred US$ 7m to the Tanzanian government, paid by Standard Bank as a compensation payment as a result of its failure to prevent bribery in Tanzania. In November 2015, a UK court ordered the bank to pay a fine of US$ 25m, plus this compensation payment to the Tanzanian government. [See TA114 for details of the case].