by Ben Taylor

Prime Minister Pinda with Justine Greening (extreme right), British High Commissioner Dianna Melrose and the head of DfID Marshall Elliott

The British International Development Secretary, Justine Greening, signalled a shift towards a more pro-business approach for British aid in Tanzania while visiting the country in November. She was accompanied by representatives of 18 British and international business and social enterprises, including Unilever, JCB (construction equipment), Mott Macdonald (engineering consultants), Diageo and SABMiller (brewers), and Swire Pacific Offshore (oil and gas services). It is the first time DfID has hosted such a delegation.

“The Chinese government has invested and it’s time the British government makes sure we’re helping British businesses have that advantage to invest in Africa too,” Ms Greening said.

Investments in agriculture

The Department for International Development (DfID) will invest £20m in four new partnerships with businesses and not-for-profit organisations working in Tanzania. DfID will collaborate with social enterprise and business with loans and equity, generating a return that can be reinvested. The largest partnership is with Unilever, the Wood Family Trust and the Gatsby Foundation.

DfID will invest £7.5m in “a major new tea plantation” in the southern highlands. A second investment in tea production will go to the Tanzania Tea Packers (TATEPA) Wakulima Tea Factory in Rungwe district. DfID will provide up to £2.5m to fund a hydro-power plant that will reduce energy costs and increase the factory’s productivity. Further investments are to Kilombero Plantations Ltd (£6.7m) to finance a rice husk gasification plant and £3.3m to Equity for Tanzania, to enable small agri-businesses and farmers to access finance for agricultural equipment.

These investments were announced by Ms Greening at the launch of a new High Level Prosperity Partnership (HLPP), which was attended by the Tanzanian Prime Minister, Mizengo Pinda. Tanzania is one of five countries to be part of the partnership, alongside Angola, Ghana, Ivory Coast and Mozambique.

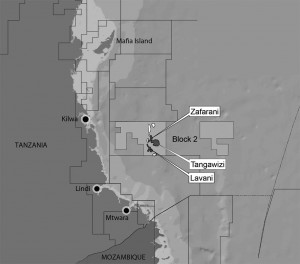

DfID hope that the partnership will see the UK and Tanzania create even closer commercial links and will “double the number of UK companies doing business in Tanzania in the renewable energy and agriculture sectors by 2015.” The partnership will focus primarily on four sectors: oil and gas, renewable energy, agriculture and strengthening business environment. The London Stock Exchange Group will provide training to financial professionals, regulators and government officials in Tanzania. Prime Minister Pinda expressed his hope “that this Partnership will open a new window of opportunity to these important areas of cooperation”.

Transport and trade

Later in her visit, Ms Greening announced initiatives aimed at reducing transport costs within East Africa. Following a visit to the Dar es Salaam port, she launched a £10.5m fund to support a scheme run by TradeMark East Africa, called the Logistics Innovation For Trade (LIFT) fund. The LIFT fund will provide match grants to encourage private sector investment in freight and other logistics technologies and business processes in East Africa. The aim is to reduce transport time along the main transport corridors in East Africa, stimulate further research and create systems for tracking industry performance and efficiency.

East Africa currently has some of the highest freight and transport costs in the world.

A new direction

Justine Greening was keen to emphasise that this initiative represents a change of direction for DfID. “For too long the development world has seen the skills and potential of the private sector as something separate to its own efforts,” she said. “I want to take a different approach. The only way for developing countries to end their dependency on aid is to create more jobs, growth and tax receipts. In the end, for individuals too, a job is the only sustainable route out of poverty. Business can bring much needed investment and innovation at a scale that can be transformational, providing prospects and economic opportunities for communities. It is sensible for us to work with business to make sure their plans help local communities. This is also firmly in our own interest, as we are helping to open up markets for British goods.”

The new approach has attracted criticism that it would benefit the wealthy more than the poor. Christine Haigh, from the World Development Movement said: “It’s clear that this initiative is very much about finding new markets for UK companies and very little about reducing poverty for the majority of Tanzanians”.

The move is the latest evolution of British aid policy in Tanzania since the Conservative-led coalition took office in 2010. There was a reduction in the aid provided as General Budget Support (from 66% in 2010/11 to less than 30% in 2013/14), but an overall increase in total aid linked to the promise to spend 0.7% of British GDP on aid. In 2010/11, DfID spent £150m in Tanzania and this will rise to £192m in 2014/15.

When Chinese President Xi Jinping visited Tanzania earlier in 2013, he signed a $500m bilateral trade deal with Tanzania and agreed a $10bn investment in a new port in Bagamoyo.