by Roger Nellist

Ministry split, new Ministers appointed

In October 2017 following the mineral sands export saga, enactment of the controversial new mining and petroleum legislation and the dismissal of the former Minister for Energy and Minerals, President Magufuli divided the Ministry of Energy and Minerals into two portfolios and appointed new top teams.

Tanzania’s new Minister for Energy is Dr Medard Kalemani, supported by Ms Subira Mgalu as Deputy Minister and by Mr Khamis Mwinyi Mvua as Permanent Secretary. Tanzania’s new Minister for Mining is Ms Angellah Kairuki, supported by Deputy Minister Stanislaus Nyongo and by Mr Simon Samuel Msanjika as Permanent Secretary.

Statoil renamed as Equinor

Meanwhile in May the large Norwegian State oil and gas company Statoil – which has discovered large gas reserves offshore Tanzania and is a key partner in the potential liquefied natural gas (LNG) project – announced it had formally changed its name to Equinor. The new name reflects the company’s values (of equality and equity) as well as its continuing Norwegian presence. The move comes at a time when it is increasing its efforts to develop new and renewable forms of energy.

LNG project in the doldrums

In recent years, large gas discoveries (estimated at about 57 tcf) have been made offshore southern Tanzania and during the last two or three years the government and the Tanzania Petroleum Development Corporation (TPDC) have been in discussions with the principal discoverers – Shell, Exxon Mobil, Ophir Energy and Equinor (Statoil) – with a view to building a large LNG export terminal onshore at Lindi. It will be a huge investment, costing an estimated US$30 billion. However, progress on realising the project has slowed recently and various factors are being cited for this.

The investors are blaming government for the bureaucratic procedures they face in acquiring land to build the plant on as well as the uncertainty introduced into the overall energy regulatory environment by the tough new legislative provisions. (See articles in earlier TA bulletins). Crucially, the Host Government Agreement terms have yet to be agreed, without which the LNG project cannot proceed. Further uncertainty arose this summer when Exxon Mobil indicated it was seeking a buyer for its 35% interest in the big gas reserves in Tanzania’s offshore deep water Block 2 (where Equinor, the operator, holds 65%). There have also been worries about the substantial fall (by about one third) in world gas prices since 2015.

Observers suggest that relations between the gas developers and the government are strained and that a final investment decision on the Tanzanian LNG project seems unlikely before the early 2020s. To help move matters along, in April TPDC announced it was recruiting international advisers to assist it to formulate an appropriate commercial framework for the project.

Three critical parliamentary committee reports

In Dodoma in May the Parliamentary Energy and Minerals Committee criticised the Ministry of Energy for its slow progress in implementing the LNG project, and called on the government to fast-track its negotiations with the investors – so as not to lose crucial overseas gas markets to competition from other major gas producers. They pointed to neighbouring Mozambique, which has gas reserves three times larger than those so far discovered in Tanzania and is also more advanced with its gas commercialisation plans.

In response, Minister Kalemani told Parliament that government was still in discussions with the multinational investors and that conceptual design work and initial project evaluation had been completed. He said government had already budgeted TSh 6 billion to fund pre-front end engineering design of the LNG plant as well as to compensate people affected by the project.

Then on 25 June Dr Kalemani told Parliament that “everything is progressing well” and that actual construction of the LNG plant would start in 2022. He said the multinational investors were currently competing among themselves to determine which of them will lead the project execution.

On a related gas matter the same Committee also criticised his Ministry for the slow speed at which it was connecting homes in Dar to the gas supply. Minister Kalemani responded saying that 70 homes were already connected, another 1,000 would be served in the near future and that TPDC would be spending about TSh 21 billion next year putting in place the necessary infrastructure to supply a further 2,000 homes.

Also in June the Parliamentary Budget Committee asked government for an analysis of the reasons for the fall in exploration activity in Tanzania in the last year. No new wells have been drilled and concerns were heightened by the unsettling reports in June that Exxon Mobil was seeking to leave Tanzania in favour of a bigger LNG project in Mozambique. Minister Kalemani told Parliament: “It is true that Mozambique is doing well but Tanzanians should also understand that we are not very far from that stage”. TPDC sought to reassure stakeholders and the public about the Exxon Mobil sell-out too, commenting that such a move was normal business practise for the big multinationals, adding: “when it comes to energy investment never be in a hurry. This might just be a change of strategy or change of management”. An Equinor (Statoil) spokesman confirmed that they were proceeding with business as usual, having already invested a very large sum of money in Tanzania drilling 15 wells (and making nine discoveries).

In June too a special Parliamentary Committee that was established at the end of last year to investigate the 11 Production Sharing Agreements so far signed with government reported that gas is being produced under only three of them. Naming the five former Energy Ministers who signed all the agreements with TPDC and various international oil companies, the Committee asserted that what it viewed as shortcomings and loopholes in the terms were resulting in financial losses to government amounting to hundreds of billions of shillings. In particular, the Committee pointed to the supposed lopsided nature of the provisions in the various agreements with Songas and advised government not to renew the power production and gas drilling contracts with Songas when they expire in 2024. It highlighted the various assets of TANESCO and TPDC that were effectively given free to Songas in return for which the Committee believes those two parastatals were not awarded adequate shareholdings in the project.

The Attorney General responded, telling Parliament that government was now reviewing all the contracts with Songas. But Pan Africa Energy Tanzania – the developer and operator of the producing Songo Songo gas field and Songas – expressed concern at the “inaccurate findings and allegations” made by the special Committee, stating it had complied with the terms of its agreements with government and pointed to its impeccable operational record and the significant economic benefit its operations had already brought to Tanzania.

Other petroleum and mining sector problems

In April, Swala Oil and Gas declared ‘force majeure’ under the terms of its Kilosa-Kilombero Production Sharing Agreement with government and TPDC, saying it was “disappointed and frustrated” by the demand for it to undertake a special environmental impact assessment (EIA) of the likely implications for the proposed Stiegler’s Gorge hydropower dam of the company’s use of water during the drilling of its first exploration well (Kito-1) next year. The government has already approved an EIA that Swala undertook in 2017 and the amount of water to be consumed in the drilling of the well will be a tiny fraction of that pertaining to the dam. Swala has so far spent more than $20 million exploring for oil and gas in Tanzania.

Given the continuing ban on the export of gold and copper concentrates, Acacia Mining Tanzania announced in April that during 2018 it will be producing 40% less gold than it did in 2016 and, with no end then in sight to the ongoing discussions between its parent – Barrick Gold – and the government, the company was being forced to cut costs and unfortunately would have to lay off an unspecified number of workers at its Tanzanian mines. Acacia employs about 2,800 workers in the country, 96% of whom are Tanzanian.

In June the Minister for Constitution and Legal Affairs, Prof Palamagamba Kabudi, told Parliament during the debate on the Ministry of Minerals’ budget that the ongoing discussions between government and Barrick “are in the final stages and things are in good order”; however, the US$300 million good faith payment to Tanzania promised earlier by Barrick/Acacia will only be paid once the discussions are concluded.

In a Canadian (Fraser Institute) global mining survey of 2,700 mining companies operating around the world, Tanzania’s perceived ‘mining investment attractiveness’ dropped 19 places on the world listing, falling from 59th position in 2016 to 78th position last year. The substantial deterioration is blamed on the adverse legislative changes in 2017 (especially their retrospective application) and on what some investors in Tanzania see as excessive and random taxation of their mineral operations. Of the 91 countries surveyed 15 were African and Tanzania ranked only 12th out of the 15 – behind Ghana, Mali, Botswana, South Africa, DRC, Namibia, Zambia, Morocco, Zimbabwe, Burkina Faso and Ivory Coast, and only a little ahead of Ethiopia, Mozambique and Kenya (the worst).

Some good news: Miombo Hewani Wind Farm

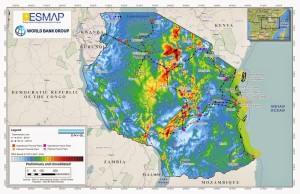

In June, Windlab Limited announced that its Tanzanian subsidiary will be constructing a large wind turbine farm with associated electrical infrastructure at a location in Southern Central Tanzania close to Makambako (where it will connect with the national grid). The Miombo Hewani wind project will be built in phases and now has approval for a total generating capacity of 300 MW. The first phase (costing US$300 million) will involve the construction of 34 wind turbines that will deliver about 100 MW of electricity, also creating jobs and extra income in Njombe Region. This wind project will therefore add significantly to Tanzania’s current power generation capacity of just over 1,300 MW (comprising 560 MW of hydropower and 750 MW of thermal gas and diesel), importantly also diversifying the generating source.

In making the announcement the CEO of Windlab Limited, said: “We are very pleased to receive the first Environmental and Social Impact Assessment certificate for a wind farm in Tanzania. In developing Miombo Hewani, Windlab has applied the industry best practices and experience it has gained from developing more than 50 wind energy projects across North America, Australia and Southern Africa”. He added that Miombo Hewani enjoys an excellent wind resource, one of the best in the world. Moreover, the wind pattern there is biased towards night time generation and generation during Tanzania’s dry season, making it an ideal addition to Tanzania’s current and planned electricity generation mix. Windlab Tanzania said that the wind farm is expected to operate for at least 25 years and should generate enough power to supply nearly 1 million average Tanzanian homes.